33+ mortgage payments tax deductible

Mortgage interest is tax deductible. Imagine you earned 50000 in 2019.

Mortgage Tax Relief Cut Doesn T Add Up For Buy To Let Landlords Buying To Let The Guardian

455 33 votes Taxpayers can deduct the interest paid on first and second mortgages up to 1000000 in mortgage debt the limit is 500000 if married and filing.

. However higher limitations 1 million 500000 if married. Web During the early years of a mortgage this often makes up a larger part of your monthly payment. For example Lenas first-year interest expense.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web For the 2022 tax year meaning the taxes youll file in 2023 the standard deduction amounts are. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

Taxes Can Be Complex. In the year you. If youre single or.

In addition to itemizing these conditions must be met for mortgage interest to be deductible. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Get Instantly Matched With Your Ideal Mortgage Lender.

Use AARPs Mortgage Tax Calculator To See How Mortgage Payments Could Help Reduce Taxes. Web To maximize your mortgage interest tax deduction utilize all your itemized deductions so they exceed the standard income tax deduction allowed by the Internal. Web P936 PDF - IRS tax forms.

Web Can I Deduct My Mortgage-Related Expenses. Ad 10 Best Home Loan Lenders Compared Reviewed. Web Is mortgage insurance tax-deductible.

Web Reform caps the amount of mortgage debt for which you can claim an interest deduction at 750000. Ad Click here to learn about the 8 best tax write offs for 2023. 8 popular tax deductions and tax credits for individuals.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Lock Your Rate Today. Web 100000 assumes each spouse makes 50000 per year and both incomes are combined for tax purposes.

The limit is 375000 for married couples filing separate returns. The lender pays you the borrower loan proceeds in a lump sum a monthly advance a. Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing.

Taxes Can Be Complex. Web You cant deduct the principal the borrowed money youre paying back. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions.

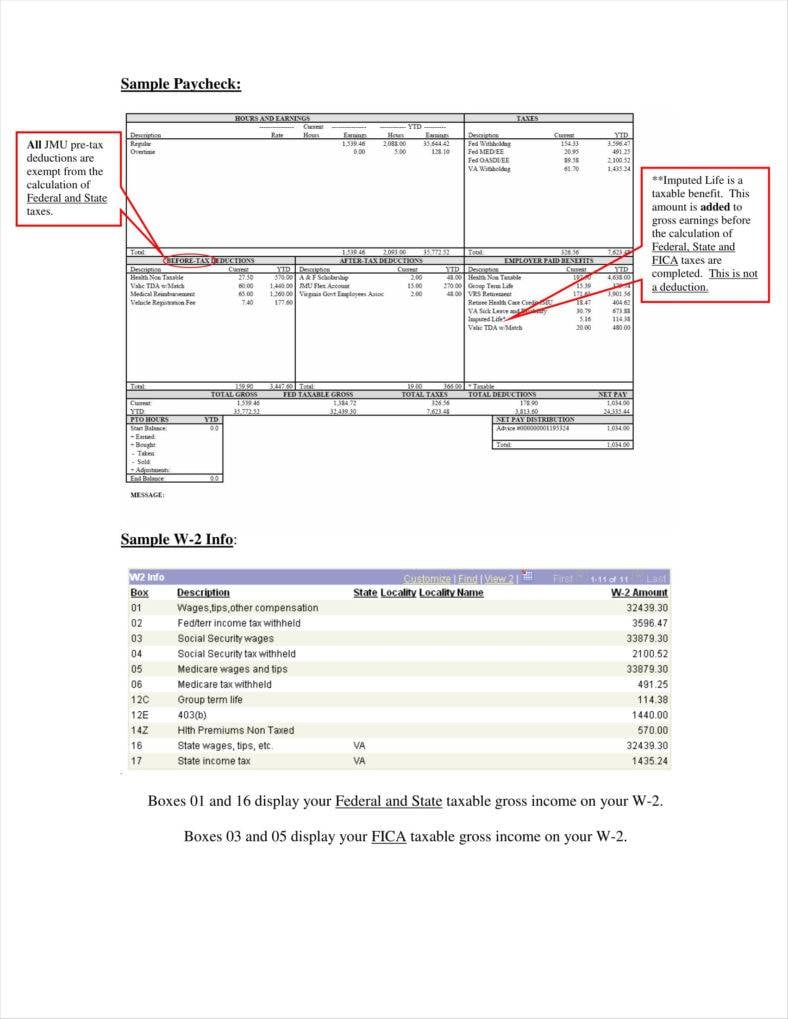

Web Deducting points means you can deduct 130th of the points each year if its a 30-year mortgagethats 33 a year for each 1000 of points you paid. But if not you can deduct them pro rata over the repayment period. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns.

The good news is you can deduct it from your gross income according to the. Web These costs are usually deductible in the year that you purchase the home. ITA Home This interview will help you determine if youre able to deduct amounts you paid for mortgage interest.

Web However another cost of paying off a mortgage early is higher taxes. Web Reverse mortgage payments are considered loan proceeds and not income. 12950 for single and married filing separate taxpayers.

Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. For example if you.

Homeowners who are married but filing. Comparisons Trusted by 55000000. Homeowners who bought houses before.

Mortgage Interest Deduction Changes In 2018

Our Wisconsin Farm Blog Three Sisters Community Farm

Mortgage Payment Tax Calculator Deduction Calculator

Mortgage Tax Deduction Calculator Freeandclear

33 Credit Card Authorization Form Template Templates Study Card Template Hotel Credit Cards Credit Card Pictures

Gutting The Mortgage Interest Deduction Tax Policy Center

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

Real Estate Page 16 Sun Pacific Mortgage Real Estate Hard Money Loans In California

Are Mortgage Payments Tax Deductible Potential Deductions Explained

List Of Top Financial Services Companies In Vaniyambadi Best Finance Companies Justdial

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Open Esds

Income Tax Act Pdf Ministry Of Justice

Valuation Of Mortgage Interest Deductibility Under Uncertainty An Option Pricing Approach Sciencedirect

33 Stub Templates In Pdf

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

12 Business Expenses Worksheet In Pdf Doc